Law

Intellectual Property Rights in the Age of Digital Content: Navigating Copyright Issues

Intellectual Property Rights in the Age of Digital Content: Navigating Copyright Issues

In today’s digital age, the protection of intellectual property rights has become more crucial than ever. With the rapid growth of digital content creation and distribution, navigating copyright issues has become a complex task for content creators, businesses, and consumers alike. Understanding the intricacies of intellectual property rights is essential to avoid legal pitfalls and ensure fair compensation for creators. This article delves into the world of intellectual property rights in the digital age, shedding light on copyright issues and providing guidance on how to navigate them effectively.

The Basics of Intellectual Property Rights

Intellectual property rights encompass a range of legal protections granted to creators and owners of intellectual property, including copyrights, trademarks, and patents. Copyright, in particular, is a crucial aspect of protecting digital content. It grants creators the exclusive right to reproduce, distribute, and display their work. In the digital realm, copyright extends to various forms of content, such as text, images, videos, and software.

Understanding Copyright in the Digital Age

The digital landscape has transformed the way content is created, shared, and consumed. With the ease of copying and distributing digital content, copyright infringement has become a prevalent issue. Content creators must be vigilant in protecting their work from unauthorized use and reproduction. Digital rights management tools and copyright notices can help deter infringement and enforce copyright protection.

Challenges in Enforcing Copyright Online

Enforcing copyright in the online environment poses unique challenges due to the global nature of the internet and the ease of sharing content across borders. Content creators often face difficulties in monitoring and enforcing their rights, especially when dealing with infringing websites and platforms. Legal frameworks and international treaties play a crucial role in addressing cross-border copyright issues and ensuring effective enforcement mechanisms.

Emerging Trends in Intellectual Property Protection

The digital age has given rise to new trends in intellectual property protection, such as the use of blockchain technology for copyright management and licensing. Blockchain offers a decentralized and secure platform for tracking ownership rights and managing digital assets. Smart contracts powered by blockchain technology can automate licensing agreements and ensure fair compensation for creators.

Strategies for Protecting Digital Content

Content creators can employ various strategies to protect their digital content and safeguard their intellectual property rights. Watermarking images and videos, using encryption techniques, and implementing access controls are effective measures to prevent unauthorized use and distribution. Regular monitoring of online platforms and proactive enforcement of copyright can help deter infringement.

Legal Considerations for Copyright Compliance

Compliance with copyright laws is essential for content creators and businesses operating in the digital space. Understanding the limitations and exceptions to copyright, such as fair use and transformative works, is crucial for navigating copyright issues responsibly. Seeking legal advice and obtaining proper licenses for using copyrighted material can mitigate the risk of infringement.

Impact of Artificial Intelligence on Copyright

The advent of artificial intelligence (AI) has raised new challenges and opportunities in the realm of copyright. AI-generated content and automated content creation tools have blurred the lines of authorship and ownership. Addressing issues of attribution, ownership, and liability in AI-generated works requires a nuanced understanding of copyright law and ethical considerations.

International Copyright Law and Cross-Border Enforcement

International copyright law plays a vital role in harmonizing intellectual property protection across borders and facilitating cross-border enforcement. Treaties such as the Berne Convention and the WIPO Copyright Treaty establish minimum standards for copyright protection and enforcement globally. Collaborative efforts among countries are essential to combatting online piracy and ensuring a level playing field for creators.

Technological Solutions for Copyright Protection

Technological advancements offer innovative solutions for enhancing copyright protection in the digital age. Content identification tools, content recognition algorithms, and digital fingerprinting technologies enable content creators to monitor and track their work online. Automated takedown systems and copyright enforcement platforms help streamline the process of addressing copyright infringement.

FAQs

1. What is the significance of intellectual property rights in the digital age?

In the digital age, intellectual property rights are crucial for protecting the creations of individuals and businesses. Copyright, trademarks, and patents safeguard innovation and creativity, ensuring fair compensation for creators.

2. How can content creators protect their digital content from copyright infringement?

Content creators can protect their digital content by using watermarks, encryption, and access controls. Regular monitoring of online platforms and proactive enforcement of copyright are essential strategies.

3. What are the challenges of enforcing copyright online?

Enforcing copyright online poses challenges due to the global nature of the internet and the ease of sharing content across borders. Legal frameworks and international treaties play a key role in addressing cross-border copyright issues.

4. How does blockchain technology impact copyright management?

Blockchain technology offers a secure platform for tracking ownership rights and managing digital assets. Smart contracts powered by blockchain can automate licensing agreements and ensure fair compensation for creators.

5. What legal considerations should content creators keep in mind for copyright compliance?

Content creators should be aware of copyright limitations and exceptions, such as fair use and transformative works. Seeking legal advice and obtaining proper licenses are essential for compliance with copyright laws.

6. How does artificial intelligence influence copyright issues?

Artificial intelligence has raised challenges in attribution, ownership, and liability for AI-generated content. Addressing these issues requires a nuanced understanding of copyright law and ethical considerations.

7. What role does international copyright law play in cross-border enforcement?

International copyright law harmonizes intellectual property protection globally and facilitates cross-border enforcement. Treaties like the Berne Convention establish minimum standards for copyright protection.

Law

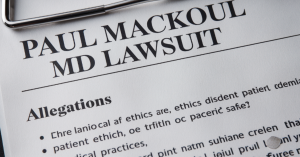

paul mackoul md lawsuit

Paul Mackoul MD Lawsuit: Unraveling Its Implications for Medical Ethics and Patient Safety

The Paul Mackoul MD lawsuit has attracted widespread attention, becoming a focal point for discussions around medical ethics, patient care, and the accountability of healthcare professionals.

Dr. Paul Mackoul, a gynecologic surgeon renowned for his expertise in minimally invasive procedures, faces allegations that have deeply impacted his career and highlighted crucial issues within the healthcare industry.

This article delves into the complexities of the lawsuit, exploring its background, allegations, legal proceedings, and broader implications.

We’ll also examine lessons for the medical community, patients, and policymakers to ensure ethical and safe practices in healthcare.

Understanding the Background of the Paul Mackoul MD Lawsuit

Dr. Paul Mackoul’s reputation as a leader in minimally invasive gynecologic surgeries has been overshadowed by legal challenges that question his medical practices. The allegations against him began with concerns about his surgical techniques and extended into his private surgical center operations, sparking extensive legal scrutiny.

Timeline of Events

- 2001: Concerns about Dr. Mackoul’s competence and conduct surfaced, leading to the loss of hospital privileges.

- 2015: A critical case involving a uterine cancer patient brought his practices into sharp focus, leading to widespread allegations.

- Present: Over 40 lawsuits have been filed, accusing him of negligence, surgical errors, and failure to meet professional standards.

Read Also: iphone:5e5ylhajjw4= wallpaper

Core Allegations in the Paul Mackoul MD Lawsuit

The lawsuit encompasses a range of claims that highlight potential lapses in medical ethics and patient care standards. These allegations raise serious questions about how medical professionals balance expertise with accountability.

1. Medical Negligence

One of the central accusations is medical negligence, with claims that procedural errors led to severe complications, including fatalities. This has raised concerns about the consistency and safety of the surgical methods employed.

2. Lack of Informed Consent

Patients have alleged that Dr. Mackoul failed to adequately inform them of the risks associated with their procedures. Informed consent is a cornerstone of medical ethics, and its absence is a significant breach of trust.

3. Breach of Professional Standards

Accusations include improper diagnoses, inadequate post-operative care, and a failure to adhere to established surgical protocols. These lapses are cited as contributing factors to poor patient outcomes.

4. Emotional and Psychological Impact

Beyond physical harm, patients report enduring emotional distress due to complications and unmet expectations from procedures performed by Dr. Mackoul.

Where Does the Case Stand? Legal Developments!

The legal proceedings have grown in complexity, with lawsuits filed across multiple states. The evolving nature of the case has brought widespread attention to Dr. Mackoul’s practices and the broader issues they represent.

Current Status

- 42 Pending Lawsuits: Spanning multiple jurisdictions, these lawsuits allege a consistent pattern of negligence.

- Potential Outcomes: Financial compensation, suspension or revocation of Dr. Mackoul’s medical license, and stricter regulatory measures for surgical centers.

Broader Legal Implications

The outcomes of this case could influence policy changes, enforce stricter compliance standards, and serve as a deterrent against medical malpractice in the healthcare industry.

The Impact on Dr. Paul Mackoul’s Career and Reputation

The allegations against Dr. Mackoul have had far-reaching consequences for his professional life and standing within the medical community.

Reputation Damage

Once celebrated for his innovative techniques, Dr. Mackoul now faces widespread criticism, jeopardizing his credibility and relationships with both peers and patients.

Challenges in Career Recovery

Regaining patient trust and professional credibility poses a significant challenge. This case underscores the critical role of accountability in sustaining a successful medical career.

Lessons for the Medical Community

The Paul Mackoul MD lawsuit is a cautionary tale for healthcare professionals, emphasizing the importance of ethical practices, patient safety, and transparent communication.

1. The Need for Rigorous Training

Continuous education and adherence to the latest surgical standards are vital for maintaining competence and minimizing errors.

2. Importance of Patient-Centered Care

Medical practitioners must prioritize informed consent and clear communication to ensure patients fully understand their treatment plans.

3. Strengthening Oversight

Hospitals and regulatory bodies must implement stricter oversight mechanisms to identify and address potential risks in medical practices.

How Patients Can Protect Themselves?

The case serves as a reminder for patients to take an active role in their healthcare decisions. Here are steps to ensure safe medical treatment:

- Research Medical Professionals: Verify credentials, read reviews, and consult trusted sources.

- Understand the Procedure: Ask detailed questions about risks, alternatives, and expected outcomes.

- Vet Surgery Centers: Ensure the facility is accredited and meets high safety standards.

- Seek Second Opinions: Consult multiple experts before undergoing major surgical procedures.

Broader Implications for the Healthcare Industry

The lawsuit has exposed gaps in regulatory frameworks, prompting calls for reforms to enhance patient safety and accountability in medical practices.

Potential Policy Changes

- Enhanced Compliance Standards: Stricter protocols for surgical procedures and reporting mechanisms.

- Increased Accountability: Greater emphasis on professional responsibility and ethical conduct.

Promoting Transparency

Healthcare providers must foster a culture of openness, encouraging patients to voice concerns and participate in their treatment decisions.

Moving Forward: Ensuring Ethical Healthcare Practices

The Paul Mackoul MD lawsuit underscores the non-negotiable importance of ethical conduct and patient safety in the medical field. By learning from this case, the medical community can implement measures to prevent similar incidents and rebuild public trust.

FAQs About the Paul Mackoul MD Lawsuit

1. What is the Paul Mackoul MD lawsuit about?

The lawsuit involves allegations of medical negligence, surgical errors, and breaches of professional standards by Dr. Paul Mackoul.

2. How many lawsuits have been filed against Dr. Mackoul?

Currently, there are 42 lawsuits pending against Dr. Mackoul across multiple states.

3. What are the key allegations in the case?

The allegations include negligence, lack of informed consent, improper diagnoses, and inadequate post-operative care.

4. How has the lawsuit impacted Dr. Mackoul’s career?

The lawsuit has severely affected his professional reputation and raised questions about his surgical practices.

5. What are the broader implications of this case?

The case highlights the importance of ethical medical practices, patient safety, and regulatory oversight in the healthcare industry.

6. What legal outcomes are possible in this case?

Potential outcomes include financial compensation for affected patients, disciplinary actions against Dr. Mackoul, and regulatory reforms.

7. How can patients ensure safe medical care?

Patients should research providers, understand procedures, seek second opinions, and choose accredited facilities.

8. What lessons can the medical community learn from this case?

Healthcare professionals must prioritize ethical practices, maintain competence through continuous education, and ensure clear patient communication.

9. Will this case lead to changes in healthcare regulations?

It is likely to prompt stricter compliance standards and oversight mechanisms within the medical industry.

10. Why is this case significant?

The case serves as a critical reminder of the consequences of medical malpractice and the importance of upholding ethical standards in healthcare.

Law

white oak global advisors lawsuit settlement

White Oak Global Advisors Lawsuit Settlement: A Case Study in Fiduciary Responsibility

The financial sector is built on a foundation of trust and ethical responsibility, particularly in areas like retirement fund management.

The recent White Oak Global Advisors lawsuit settlement with the New York State Nurses Association (NYSNA) Pension Plan shines a spotlight on the crucial concept of fiduciary duty in investment management.

This article dives deep into the case details, ERISA implications, and the broader message for financial firms responsible for safeguarding pension assets.

Background of the White Oak Global Advisors Lawsuit Settlement

In a pivotal case for investment ethics, White Oak Global Advisors reached a settlement with NYSNA after allegations of mismanagement.

The White Oak Global Advisors lawsuit settlement highlights the serious obligations investment firms have when managing pension funds, as well as the risks involved when fiduciary duties are not met.

This case is particularly significant because it deals with the financial security of essential workers—New York’s nurses—whose retirement funds are safeguarded by the NYSNA Pension Plan.

Key Allegations Leading to the Settlement

The NYSNA Pension Plan filed its lawsuit against White Oak Global Advisors in 2018, accusing the firm of several breaches:

- Mismanagement of Pension Assets: NYSNA alleged that White Oak Global Advisors failed to follow prudent investment practices, compromising the fund’s stability.

- Undisclosed Executive Negotiations: According to the lawsuit, White Oak engaged in secretive negotiations around executive roles, which raised concerns about potential conflicts of interest.

- Breach of Fiduciary Duty under ERISA: ERISA requires that pension fund managers act solely in beneficiaries’ best interests. The lawsuit argued that White Oak Global Advisors violated this duty, leading to biased investment decisions.

The outcome of this case, now known as the White Oak Global Advisors lawsuit settlement, underscores the importance of transparency and fiduciary responsibility in financial management.

Fiduciary Duty and ERISA: Core Issues in the White Oak Global Advisors Lawsuit Settlement

Central to the White Oak Global Advisors lawsuit settlement is the principle of fiduciary duty, specifically in the context of the Employee Retirement Income Security Act (ERISA).

ERISA provides stringent guidelines for those managing employee retirement funds, ensuring that beneficiaries’ interests are always prioritized.

Understanding Fiduciary Duty

Fiduciary duty requires that financial advisors manage investments with utmost care, loyalty, and transparency.

This duty is essential in pension fund management, where the livelihood of retirees depends on responsible investment.

In the White Oak Global Advisors lawsuit settlement, fiduciary responsibility came under scrutiny as NYSNA alleged that White Oak breached this duty, resulting in compromised financial security for its pension plan members.

Arbitration and Court Ruling in the White Oak Global Advisors Lawsuit Settlement

After the lawsuit was filed, the dispute between NYSNA and White Oak Global Advisors moved to arbitration.

The arbitrator examined the evidence presented by both parties and ultimately ruled in favor of NYSNA, which led to the White Oak Global Advisors lawsuit settlement.

Financial Penalties and Settlement Terms

The White Oak Global Advisors lawsuit settlement required the firm to address several financial repercussions, including:

- Return of Mismanaged Funds: White Oak Global Advisors was ordered to return over $96 million to the NYSNA Pension Plan, a significant financial penalty that represents the alleged mishandled assets.

- Forfeiture of Management Fees: White Oak had to relinquish all fees earned during the period in question, underscoring the importance of accountability.

- Coverage of Legal Costs: Additionally, White Oak Global Advisors was required to pay for the legal expenses incurred by NYSNA during the litigation.

The outcome of the White Oak Global Advisors lawsuit settlement reflects the financial consequences that can arise when fiduciary duties are disregarded, serving as a reminder to the entire financial services industry.

Lessons Learned from the White Oak Global Advisors Lawsuit Settlement

The White Oak Global Advisors lawsuit settlement offers key insights into the responsibilities of fiduciaries in investment management and highlights the potential repercussions of breaching these duties.

The Value of Transparency in Financial Management

One of the main issues in the White Oak Global Advisors lawsuit settlement was a lack of transparency, particularly regarding undisclosed negotiations that raised questions of impartiality. This case illustrates how important transparency is for building trust in the financial services sector, especially when managing pension assets.

Strengthening Oversight in Investment Practices

The White Oak Global Advisors lawsuit settlement also underscores the need for robust oversight and regulatory compliance. With millions of dollars and people’s futures at stake, investment firms must adhere strictly to regulations like ERISA to avoid both financial and reputational damage.

Broader Implications of the White Oak Global Advisors Lawsuit Settlement on the Financial Sector

The White Oak Global Advisors lawsuit settlement has ripple effects across the financial industry, serving as a case study in the importance of fiduciary responsibility and ethical investment practices.

Regulatory Changes and Enhanced Accountability

The outcome of the White Oak Global Advisors lawsuit settlement may prompt policymakers to consider strengthening ERISA regulations, offering clearer guidelines to investment firms managing pension plans.

The case emphasizes that breaches of fiduciary duty, whether due to negligence or lack of transparency, can have significant legal and financial repercussions.

Investor Awareness and Due Diligence

For individual investors and pension beneficiaries, the White Oak Global Advisors lawsuit settlement serves as a reminder to conduct due diligence when selecting fund managers.

This case highlights the importance of verifying that investment firms uphold fiduciary standards to protect beneficiaries’ interests.

Read Also: anime:6tbztsekyf0= sus

Conclusion: Key Takeaways from the White Oak Global Advisors Lawsuit Settlement

The White Oak Global Advisors lawsuit settlement illustrates the essential role fiduciary duty plays in protecting beneficiaries’ financial security.

This settlement serves as a powerful reminder to the financial industry: firms must prioritize ethical investment practices, transparency, and regulatory compliance.

Through this settlement, White Oak has underscored the severe consequences of fiduciary breaches, leaving lasting lessons for investment firms and investors alike.

FAQs

- What triggered the White Oak Global Advisors lawsuit settlement?

The lawsuit stemmed from NYSNA’s allegations against White Oak for mismanagement of pension assets and breaches of fiduciary duty, resulting in the White Oak Global Advisors lawsuit settlement. - What were the financial penalties in the White Oak Global Advisors lawsuit settlement?

The White Oak Global Advisors lawsuit settlement required the firm to return over $96 million to NYSNA, relinquish management fees, and cover the legal costs. - Why is fiduciary duty important in investment management?

Fiduciary duty ensures that investment firms act in beneficiaries’ best interests. The White Oak Global Advisors lawsuit settlement underscores the risks firms face when this duty is compromised. - What role did ERISA play in the White Oak Global Advisors lawsuit settlement?

ERISA, which mandates fiduciary standards for retirement fund managers, was central to NYSNA’s claims in the White Oak Global Advisors lawsuit settlement. - How does the White Oak Global Advisors lawsuit settlement affect the financial industry?

The White Oak Global Advisors lawsuit settlement reinforces the need for transparency, compliance with fiduciary duties, and regulatory oversight in the financial sector. - Could the White Oak Global Advisors lawsuit settlement lead to regulatory changes?

Yes, the White Oak Global Advisors lawsuit settlement might prompt lawmakers to strengthen ERISA regulations to ensure stricter compliance in pension fund management. - What can investors learn from the White Oak Global Advisors lawsuit settlement?

Investors can see the importance of choosing firms with high fiduciary standards, as demonstrated by the White Oak Global Advisors lawsuit settlement. - What was the significance of arbitration in the White Oak Global Advisors lawsuit settlement?

Arbitration provided a resolution process that examined both sides’ evidence, leading to the final decision in the White Oak Global Advisors lawsuit settlement. - How does this case impact White Oak Global Advisors’ reputation?

The White Oak Global Advisors lawsuit settlement may impact the firm’s reputation, highlighting the long-term repercussions of fiduciary breaches. - Why is the White Oak Global Advisors lawsuit settlement relevant to public sector pension plans?

The White Oak Global Advisors lawsuit settlement is particularly relevant because it involves the retirement security of New York nurses, a significant public sector group.

Law

White Oak Global Advisors Lawsuit: Allegations, Consequences, and What Investors Need to Know

White Oak Global Advisors Lawsuit: Allegations, Consequences, and What Investors Need to Know

White Oak Global Advisors, a well-known name in the investment management industry, has recently found itself at the center of a lawsuit that has caught the attention of investors, financial analysts, and legal professionals alike.

The legal dispute is raising significant concerns about the firm’s operational practices, fiduciary responsibilities, and the management of investor funds.

In this article, we will break down the key aspects of the White Oak Global Advisors lawsuit, provide insight into the allegations against the firm, and discuss the potential consequences for both the firm and its investors.

What is White Oak Global Advisors?

White Oak Global Advisors is an established investment management firm known for its focus on private credit, direct lending, and specialty finance solutions. It primarily serves middle-market businesses across a wide range of sectors, including technology, healthcare, energy, and real estate. The firm is recognized for its ability to provide flexible financing solutions, particularly in niche markets where traditional banks and lenders may not have the resources or expertise.

Despite its reputation for offering tailored investment solutions, White Oak Global Advisors now faces serious allegations of misconduct that threaten to tarnish its standing in the financial world. The White Oak Global Advisors lawsuit has brought these issues to the forefront, forcing the firm to address concerns over its practices and corporate governance.

An Overview of the White Oak Global Advisors Lawsuit

The White Oak Global Advisors lawsuit was filed by a group of plaintiffs who claim to have suffered financial losses due to the firm’s alleged mismanagement of investment funds. The lawsuit accuses the firm of breaching its fiduciary duty, engaging in negligence, and failing to disclose material information that would have influenced investors’ decisions. If these claims are substantiated, the case could have far-reaching consequences not just for White Oak, but for the broader investment community as well.

Key Allegations in the White Oak Global Advisors Lawsuit

The legal action against White Oak Global Advisors is rooted in a series of serious allegations that point to potential financial mismanagement and unethical behavior. Below, we break down the main claims brought forward in the lawsuit:

1. Mismanagement of Client Funds

The plaintiffs in the White Oak Global Advisors lawsuit claim that the firm mishandled client funds, resulting in significant financial losses for its investors. Mismanagement of funds could involve a range of practices, such as improper asset allocation, high-risk investments without adequate disclosure, or failure to monitor and mitigate risk effectively.

2. Non-disclosure of Material Information

Another major point of contention in the lawsuit is the firm’s failure to disclose critical information about investment strategies and risks. Allegations suggest that White Oak Global Advisors did not provide sufficient details about the potential downsides of certain investment opportunities, leaving investors vulnerable to unforeseen risks.

3. Misrepresentation of Investment Opportunities

The lawsuit also claims that White Oak Global Advisors misrepresented the potential returns and associated risks of certain investment opportunities. Investors argue that they were led to believe that investments would generate substantial returns, only to face disappointing results. Misrepresentation of investment opportunities can significantly undermine trust in the firm and may have serious legal implications if proven to be intentional.

What the Plaintiffs Are Claiming? Specific Grievances!

In addition to the broad allegations mentioned above, the lawsuit includes specific grievances that provide further insight into the plaintiffs’ claims. These grievances include:

1. Negligence in Due Diligence

One of the core complaints revolves around the firm’s failure to conduct thorough due diligence when evaluating investment opportunities. Plaintiffs argue that White Oak Global Advisors did not adequately assess the risks associated with some of its investment projects, leading to financial losses that could have been avoided with more careful analysis.

2. Prioritizing Firm Interests Over Investors’ Best Interests

The plaintiffs allege that White Oak Global Advisors prioritized its own financial interests over those of its investors. They claim the firm engaged in actions that benefited the company at the expense of the investors’ financial well-being, which is a clear violation of fiduciary duty.

3. Breach of Fiduciary Duty

At the heart of the lawsuit is the claim that White Oak Global Advisors breached its fiduciary duty. As a financial advisor, the firm has a legal and ethical obligation to act in the best interests of its clients. Plaintiffs argue that by failing to disclose critical information, misrepresenting investment risks, and prioritizing firm profits over investor interests, the firm violated this fiduciary responsibility.

The Financial Impact on White Oak Global Advisors and Its Investors

The White Oak Global Advisors lawsuit could have significant financial implications for both the firm and its investors. If the plaintiffs’ claims are upheld in court, White Oak Global Advisors may face hefty financial penalties, legal fees, and a loss of reputation within the investment community.

Reputational Damage

Even if the case is settled without a court ruling, the reputational damage to White Oak Global Advisors could be irreversible. In the world of finance, trust is paramount, and the firm’s failure to meet fiduciary responsibilities may lead to a decline in investor confidence. A tarnished reputation could make it more difficult for White Oak to attract new clients or retain existing ones.

Financial Penalties and Settlements

In the event of a settlement or ruling in favor of the plaintiffs, White Oak Global Advisors could face significant financial penalties. This could involve the reimbursement of investor funds, compensation for damages, and potentially hefty legal fees. The lawsuit could set a precedent for similar cases in the industry, leading to stricter scrutiny of investment firms’ practices moving forward.

Investor Losses and Compensation

For the investors involved in the lawsuit, the potential for compensation will depend on the outcome of the case. If the court finds in favor of the plaintiffs, they may be entitled to financial restitution for their losses. However, the long-term effects on investors’ portfolios could be more complicated, particularly if the firm’s financial stability is compromised as a result of the lawsuit.

How White Oak Global Advisors May Defend Itself? Legal Strategy!

As the White Oak Global Advisors lawsuit unfolds, the firm’s legal team will likely mount a defense against the claims. Some potential legal strategies the firm could employ include:

1. Challenging the Allegations of Mismanagement

White Oak may argue that it adhered to sound investment practices and that the plaintiffs’ losses were due to market conditions or other external factors. They may seek to prove that they acted in the best interests of investors, despite the allegations.

2. Defending Against Non-disclosure and Misrepresentation Claims

The firm could also defend itself against claims of non-disclosure and misrepresentation by arguing that all relevant information was provided to investors, and that the risks associated with investments were appropriately disclosed.

3. Contesting the Breach of Fiduciary Duty

White Oak Global Advisors may challenge the breach of fiduciary duty claims by asserting that it took reasonable steps to protect investor interests and adhered to legal obligations. They may argue that the plaintiffs misinterpreted or misunderstood certain investment opportunities.

What Does This Lawsuit Mean for the Future of Investment Firms?

The White Oak Global Advisors lawsuit could have a far-reaching impact on the investment management industry. If the case results in a ruling that holds the firm accountable for its actions, it may prompt other financial institutions to reevaluate their internal policies and practices regarding fiduciary duties, transparency, and risk management.

Furthermore, investors may become more cautious when entrusting their funds to private investment firms, especially those involved in direct lending or alternative investment strategies. This could lead to greater regulatory scrutiny and a shift toward more transparent and accountable investment practices across the industry.

Read Also: coyyn

Conclusion: What Investors Should Take Away from the White Oak Global Advisors Lawsuit

The White Oak Global Advisors lawsuit serves as a reminder of the importance of due diligence, transparency, and ethical practices in the investment world. Investors should carefully evaluate the firms they trust with their capital, ensuring that these companies uphold their fiduciary duties and maintain high standards of transparency and accountability.

FAQs About White Oak Global Advisors Lawsuit:

What is the White Oak Global Advisors lawsuit about?

The lawsuit involves allegations of mismanagement, negligence, and breach of fiduciary duty by White Oak Global Advisors, with plaintiffs claiming financial losses due to improper handling of investment funds.

What are the key allegations in the lawsuit?

The primary allegations include mismanagement of client funds, non-disclosure of critical information, and misrepresentation of investment opportunities.

How could the lawsuit affect White Oak Global Advisors?

The lawsuit could lead to financial penalties, reputational damage, and a loss of investor confidence, affecting the firm’s future prospects.

What are fiduciary duties in investment management?

Fiduciary duties require investment firms to act in the best interests of their clients, provide full disclosure of risks, and avoid conflicts of interest.

How might the lawsuit impact the investment industry?

The case may prompt increased regulatory scrutiny and encourage investment firms to adopt more transparent and accountable practices.

Can investors receive compensation from the lawsuit?

If the court rules in favor of the plaintiffs, investors could be entitled to compensation for their financial losses.

What defenses might White Oak Global Advisors use?

The firm may argue that it followed proper investment practices and that the plaintiffs’ losses were due to external factors.

What should investors learn from this lawsuit?

Investors should ensure that the firms they invest with adhere to ethical standards, provide full transparency, and prioritize their interests.

What are the consequences of a breach of fiduciary duty?

A breach of fiduciary duty can lead to legal action, financial penalties, and reputational damage, significantly impacting both the firm and its clients.

Is this lawsuit likely to set a precedent in the industry?

Yes, the outcome of this case could influence how other investment firms approach fiduciary responsibilities and transparency in the future.

-

HEALTH12 months ago

HEALTH12 months agoHealthSciencesForum.com

-

Tech1 year ago

Tech1 year agoRTG Sportsbook: A Comprehensive Guide to a Superior Betting Experience

-

Blog1 year ago

Blog1 year agoExploring Kazwire: Your Gateway to Unblocked Gaming and Web Browsing

-

Blog2 years ago

Blog2 years agoViolet Myers Passed Away: A Comprehensive Exploration

-

Blog1 year ago

Blog1 year agoWhat To Look for When Buying THCa Flower Online

-

Blog2 years ago

Blog2 years agoIs haband going out of business? Separating Rumor from Reality

-

Tech1 year ago

Tech1 year agoUnlocking the Secrets of ahr0chm6ly9wcm9ka2v5cy5uzxqvexv6ds1wcm9klwtlexmv – A Comprehensive Guide

-

Blog2 years ago

manhwa18cc