Blog

Cyber insurance coverage Silverfort: All You Need To Know In 2024

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, provides coverage to individuals and businesses against financial losses and damages resulting from cyber-related incidents.

It offers financial assistance and support in the event of cyber attacks, data breaches, or other cyber events that may compromise sensitive information, disrupt business operations, or result in financial harm.

Significance of Cyber Insurance in the Digital Age:

In today’s digital landscape, cyber insurance is paramount for businesses, providing essential financial and operational safeguards against the increasing complexity of cyber threats. Here are several critical reasons why cyber insurance is indispensable in the current digital era:

| Importance of Cyber Insurance |

| 1. Financial protection against cyber-related losses |

| 2. Risk transfer to alleviate financial burdens on organizations |

| 3. Incident response support from cyber experts |

| 4. Business continuity coverage during cyber disruptions |

| 5. Assistance with legal and regulatory compliance |

| 6. Promotion of risk management practices and prevention efforts |

| 7. Management of cyber risks in vendor and supply chain relationships |

| 8. Peace of mind through a safety net against evolving cyber threats |

Understanding Cyber Insurance Coverage:

Cyber insurance policies provide varying levels of coverage, tailored to address the specific risks and financial implications of cyber incidents. These policies typically offer coverage in two main areas:

First-party and third-party.

First-party coverage focuses on protecting the insured organization’s own losses and expenses resulting from a cyber incident. It commonly includes:

1. Data Breach Response and Investigation: Covering costs associated with incident response, including forensic investigations, notification of affected individuals, credit monitoring services, and implementing mitigation measures.

2. Business Interruption and Income Loss: Providing financial assistance to recover lost revenue and cover ongoing expenses during business disruptions caused by cyber attacks.

3. Extortion and Ransomware Payments: Offering coverage for extortion payments or expenses related to responding to ransom demands, providing financial support to resolve such situations.

4. Public Relations and Crisis Management: Assisting with public relations efforts, crisis communication, and associated expenses to manage reputational damage resulting from a cyber incident.

5. Legal Expenses: Covering legal fees and expenses, including regulatory investigations, lawsuits, and legal representation required in response to a cyber incident.

Also Read: Heardle 60s: Navigating the Heardle 60s Universe

Understanding Third-Party Cyber Insurance Coverage:

Third-party coverage in cyber insurance offers protection against claims and legal actions brought by third parties affected by a cyber incident. It encompasses the following components:

1. Liability for Data Breaches: This coverage addresses legal expenses and damages resulting from unauthorized access, theft, or release of sensitive data. It aids in defending against claims and potential liabilities arising from data breaches.

2. Legal Defense Costs: In the event of a lawsuit or legal action related to a cyber incident, this coverage assists in covering expenses associated with legal defense. It includes attorney fees, court costs, and settlements.

3. Settlements and Judgments: If the insured organization is found liable for damages, this coverage provides financial compensation for settlements and judgments resulting from third-party claims.

Types of Cyber Insurance Policies:

In cyber insurance, individuals and businesses typically have two primary options: standalone cyber insurance policies and cyber endorsements to existing insurance policies.

1. Standalone Cyber Insurance Policies:

Standalone policies are tailored to provide comprehensive coverage for cyber risks and incidents. They operate independently from other insurance policies and offer a broad array of coverage options specific to cyber risks.

These policies encompass both first-party and third-party coverages, along with additional enhancements and specialized services.

Opting for standalone cyber insurance ensures dedicated coverage designed to address the unique challenges and financial consequences of cyber incidents. They offer flexibility and customization to meet specific organizational needs.

2. Cyber Endorsements to Existing Policies:

Cyber endorsements, also known as cyber liability endorsements or riders, are add-ons to existing insurance policies. They extend the coverage of traditional policies to include cyber-related risks. These endorsements are commonly added to general liability, property, or professional liability insurance.

By incorporating a cyber endorsement, organizations can enhance their coverage against cyber risks without acquiring a separate standalone policy.

However, cyber endorsements may offer more limited coverage compared to standalone policies, serving to supplement existing coverage rather than providing comprehensive protection.

The choice between standalone cyber insurance policies and cyber endorsements hinges on factors like the organization’s risk profile, budget, existing insurance coverage, and specific requirements. Consulting with insurance professionals to evaluate available coverage options is advisable for effective cyber risk management.

Cyber Insurance Requirements:

The prerequisites for cyber insurance can vary depending on factors such as the insurance provider, policy type, and the specific needs of the insured organization.

Nonetheless, certain common factors and considerations are typically required or recommended when procuring cyber insurance. Here are some typical requirements to consider:

1. Cybersecurity Controls: Insurance providers often expect organizations to have robust cybersecurity controls in place. This entails implementing industry best practices such as multi-factor authentication, firewalls, intrusion detection systems, encryption, regular software updates, and employee awareness training.

2. Risk Assessment: Organizations may be required to conduct a comprehensive risk assessment of their cybersecurity posture. This involves identifying vulnerabilities, assessing potential threats, and evaluating the level of risk exposure. It may entail analyzing existing security measures, network infrastructure, data handling practices, and incident response capabilities.

3. Incident Response Plan: Having a well-documented incident response plan is crucial. This plan outlines the steps to be taken in the event of a cyber incident, including incident reporting, containment, investigation, and recovery procedures. Insurance providers may review and assess the effectiveness of the incident response plan during the underwriting process.

4. Data Security and Privacy Policies: Organizations may need to provide details about their data security and privacy policies. This includes information on data protection measures, access controls, data retention policies, and compliance with regulations such as the General Data Protection Regulation (GDPR) or industry-specific requirements.

5. Documentation and Compliance: Insurance applications may require organizations to furnish documentation and evidence of their cybersecurity practices and compliance with relevant regulations. This could include records of security audits, penetration testing results, compliance certifications, and prior incident reports and resolutions.

6. Risk Management and Training Programs: Organizations are often expected to have risk management programs in place to effectively mitigate cyber risks. This includes implementing regular training and awareness programs for employees to promote good cybersecurity practices and reduce vulnerabilities stemming from human error.

Average Cost of Cyber Insurance:

In the United States, the average annual cost of cyber insurance stands at approximately $1,485, although this figure may vary based on policy limits and specific risk factors.

For small business clients of Insureon, the average monthly premium is around $145, though this can significantly differ. Despite the increase in ransomware incidents, cyber insurance pricing has, on the whole, seen a decrease of 9% in 2023.

1. Businesses in Need of Cyber Insurance:

Any business that stores private information online or on electronic devices necessitates cyber insurance. This includes a broad spectrum of business types, ranging from retailers and restaurants to consultants and real estate agents.

2. Industries Requiring Cyber Insurance:

While cyber liability insurance should be integrated into insurance programs across all industries due to the escalating threat of cyberattacks, certain sectors have a heightened need for such coverage.

Industries that handle substantial volumes of sensitive data, such as healthcare, finance, and retail, are particularly reliant on cyber insurance.

Cyber Insurance Claims Process:

In the event of a cyber incident, having cyber insurance coverage can offer vital assistance. Understanding the cyber insurance claims process is essential for organizations to adeptly navigate the complexities of filing a claim and securing necessary financial support.

Filing a Cyber Insurance Claim:

- Incident Identification and Notification: Promptly report the incident to your insurer as per their procedures.

- Initial Communication and Documentation: Furnish crucial details about the incident and any immediate actions taken.

- Documentation and Evidence: Gather supporting evidence like incident reports, breach notifications, financial records, and legal correspondence.

- Claim Submission: Submit a comprehensive claim form detailing financial losses and incurred expenses accurately.

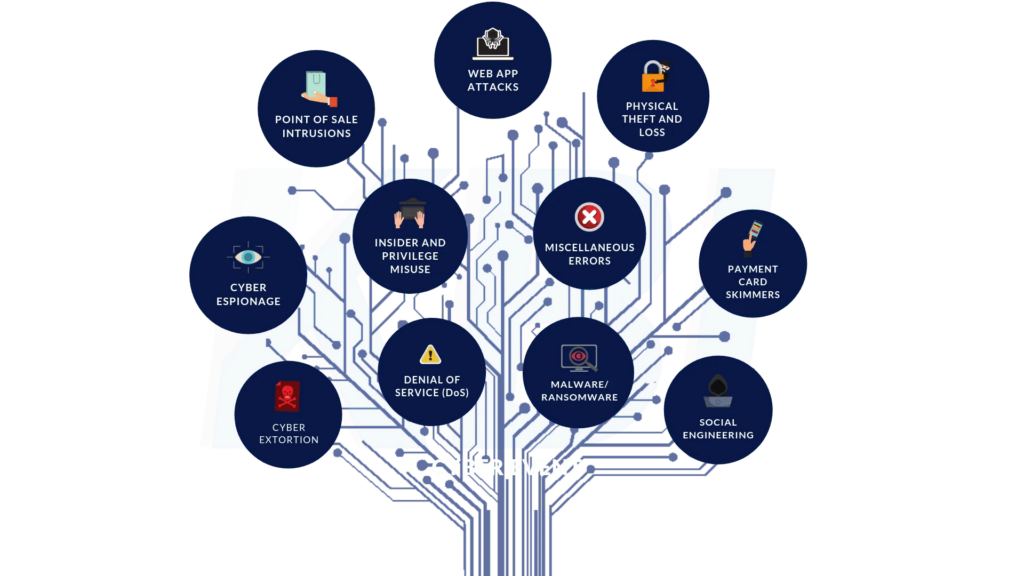

Understanding Cyber Risks:

Cyber risks entail potential harm or damage arising from malicious activities in the digital sphere. These risks encompass various threats, including data breaches, ransomware attacks, phishing attempts, malware infections, and more. The repercussions of cyber risks can be severe, impacting individuals, businesses, and even national security.

1. Examples of Cyber Threats:

To grasp the severity of cyber risks, it’s essential to examine real-world instances of prevalent cyber threats. Data breaches, involving unauthorized access to sensitive information, pose a significant concern.

Recent incidents like the Equifax and Marriott International breaches exposed millions of individuals’ personal data, underscoring the extensive fallout of such attacks.

Ransomware attacks, another pervasive threat, entail encrypting systems and demanding a ransom for their release. Notable cases include the WannaCry and NotPetya attacks, which inflicted widespread damage on organizations worldwide.

A study by IBM Security and the Ponemon Institute revealed that the average cost of a data breach was $3.86 million in 2020.

This encompasses expenses related to incident response, investigation, recovery, regulatory fines, legal proceedings, customer notification, and damage to reputation.

Ransomware attacks have surged by 71% in the past year, fueled by billions of stolen credentials available on the dark web. Threat actors are increasingly utilizing lateral movement to propagate payloads across entire environments simultaneously.

Several prominent companies, including Apple, Accenture, Nvidia, Uber, Toyota, and Colonial Pipeline, have fallen victim to recent high-profile attacks due to vulnerabilities in identity protection.

Consequently, underwriters have imposed stringent criteria that companies must

Also Read: Shift App Att: Simplify Your Move with the Att Shift App

Fulfill to qualify for coverage:

Is Multi-Factor Authentication (MFA) Required for Cyber Insurance?

The inclusion of multi-factor authentication (MFA) in cyber insurance policies varies depending on the insurance provider and specific policy terms.

However, many insurers strongly advocate for or endorse the adoption of MFA as part of cybersecurity compliance protocols.

MFA enhances security by necessitating users to provide multiple forms of verification, such

as a password and a unique code sent to a mobile device, to access systems or sensitive data.

By implementing MFA, organizations can significantly mitigate the risk of unauthorized access and safeguard against credential-based attacks.

How Cyber Insurers’ MFA Requirements Reduce Ransomware Risk

In the realm of ransomware attacks, cyber insurers’ stipulations for multi-factor authentication (MFA) serve to diminish risk in several ways:

- Enhanced Authentication Strength: Ransomware attacks frequently exploit compromised credentials, where attackers gain entry to systems or networks through stolen or weak passwords. MFA mandates the provision of an additional authentication factor (e.g., a physical token or biometric data), thwarting attackers even if they acquire or guess a password. This added layer of authentication significantly complicates lateral movement for attackers.

2. Prevention of Unauthorized Access: With MFA in place, unauthorized access remains thwarted even in scenarios where attackers possess user credentials. Without the secondary authentication factor, access to systems or networks remains inaccessible, effectively curtailing the ability of attackers to propagate ransomware across additional resources within the network.

3. Timely Detection of Unauthorized Access Attempts: MFA systems are adept at generating alerts or notifications in response to login attempts lacking the requisite secondary authentication factor. This functionality empowers organizations to swiftly identify and respond to potential unauthorized access endeavors, bolstering their ability to thwart ransomware attacks in their nascent stages.

How Cyber Insurers’ Visibility and Monitoring Requirements Mitigate Ransomware Risk

The insistence on visibility and monitoring of service accounts by cyber insurers serves as a pivotal measure in mitigating the threat posed by ransomware attacks. Here’s how:

1. Detection of Unauthorized Access: Service accounts, often endowed with elevated privileges, are prime targets for attackers due to their potential to facilitate lateral movement. Organizations can swiftly detect unauthorized access attempts or anomalous activities linked to service accounts through robust monitoring solutions. Alerts triggered by irregular login patterns or access requests empower security teams to investigate and respond promptly.

2. Identification of Abnormal Behaviors: Monitoring service accounts enables organizations to establish baselines for normal behavior and swiftly identify deviations. Anomalous activities such as unexpected resource access or attempts to escalate privileges can serve as red flags for ongoing ransomware attacks. With vigilant monitoring, security teams can promptly detect and address such aberrations before the attack escalates.

3. Limitation of Lateral Movement: Lateral movement, a hallmark of ransomware attacks, poses a significant threat to organizational networks. By closely monitoring service accounts and adhering to the principle of least privilege (POLP), organizations can restrict account access to essential resources only. This proactive measure minimizes the potential impact of compromised service accounts and impedes the ability of attackers to traverse the network freely.

4. Proactive Response and Containment: Enhanced visibility and monitoring empower organizations to respond proactively to potential ransomware threats. Security teams can promptly initiate incident response protocols upon detecting suspicious activity linked to service accounts. This may involve isolating affected systems, revoking compromised credentials, or temporarily disabling service accounts to halt the propagation of ransomware. By containing the threat in its infancy, organizations can mitigate its impact and thwart widespread encryption and data loss.

Future Trends and Developments in Cyber Insurance:

As the cyber threat landscape undergoes continual transformation, the domain of cyber insurance evolves in tandem. Keeping abreast of emerging risks, market shifts, and regulatory dynamics is imperative for individuals and entities seeking comprehensive cyber insurance coverage.

Emerging Cyber Risks and Challenges:

1. Advanced Persistent Threats (APTs): APTs, marked by sophisticated, targeted assaults, present a formidable cybersecurity hurdle. Future cyber insurance policies may necessitate provisions addressing the distinct risks associated with APTs, such as prolonged attack durations and extensive data exfiltration.

2. Internet of Things (IoT) Vulnerabilities: The expanding interconnectedness of devices and systems introduces novel cyber perils. With the proliferation of IoT deployments, cyber insurance is poised to confront risks stemming from compromised IoT devices and their potential ramifications on critical infrastructure and privacy.

3. Artificial Intelligence (AI) and Machine Learning (ML): The burgeoning utilization of AI and ML technologies heralds both opportunities and vulnerabilities. Cyber insurance is anticipated to adapt to encompass potential risks arising from AI and ML, including algorithmic biases, adversarial attacks, and unauthorized access to sensitive AI models.

Evolving Cyber Insurance Market and Products:

1. Tailored Coverage and Customization: The cyber insurance landscape is poised to offer increasingly tailored coverage options tailored to the specific requirements of diverse industries and entities. This encompasses coverage for specialized risks like cloud-based services, supply chain vulnerabilities, and emerging technologies.

2. Risk Assessment and Underwriting: Insurers are likely to augment their risk assessment and underwriting methodologies. This may entail leveraging advanced analytics, threat intelligence, and cybersecurity audits to accurately evaluate an organization’s security posture.

3. Cybersecurity Services Integration: Cyber insurance products may integrate value-added services such as cybersecurity training, incident response planning, and vulnerability assessments. Collaboration between insurers and cybersecurity firms could facilitate the provision of holistic risk management solutions.

Regulatory Considerations and Compliance Requirements

1. Evolving Data Protection Regulations: The advent of new data protection regulations, such as the GDPR and CCPA, necessitates the alignment of cyber insurance with evolving compliance mandates. Ensuring adequate coverage for regulatory fines and penalties becomes paramount.

2. Mandatory Cyber Insurance Requirements: Certain jurisdictions may contemplate imposing mandatory cyber insurance stipulations to ensure organizations possess adequate financial safeguards against cyber incidents. This trend is anticipated to propel greater global adoption of cyber insurance.

Wrapping up:

In the realm of cyber insurance, staying updated on emerging trends is vital. As cyber threats evolve, insurance offerings adapt to address new risks, from advanced persistent threats to IoT vulnerabilities.

The market responds with tailored coverage, enhanced risk assessment, and integration of cybersecurity services, all while navigating evolving regulatory landscapes.

Blog

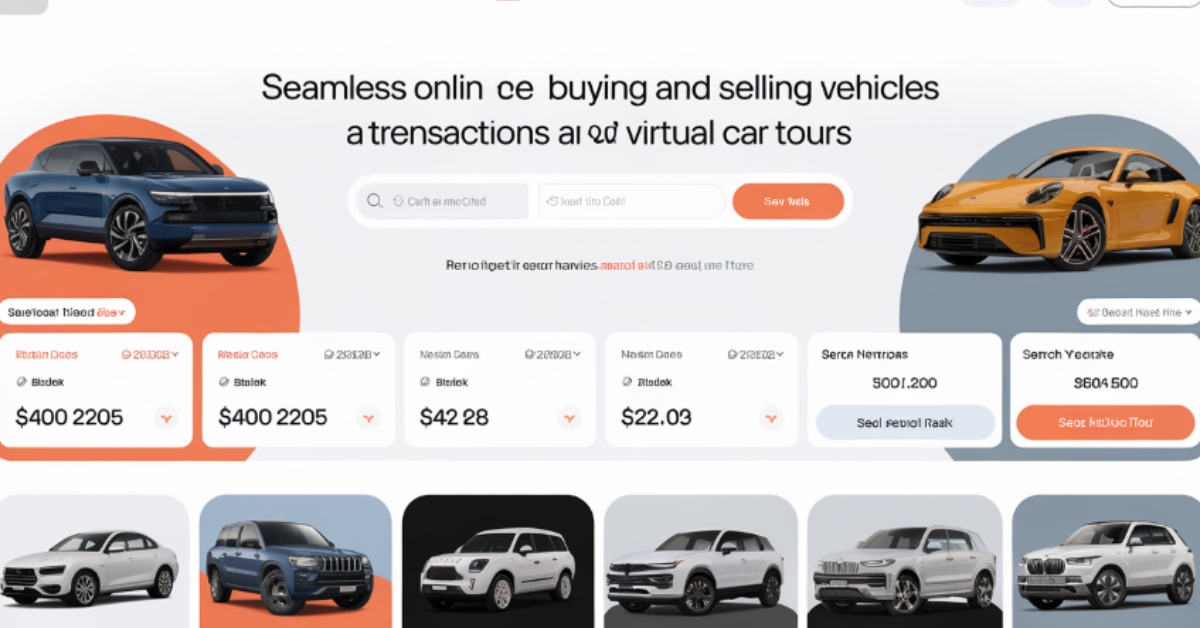

NettyAuto.net: Revolutionizing the Automotive Industry with Seamless Transactions

NettyAuto.net: Revolutionizing the Automotive Industry with Seamless Transactions

In today’s rapidly evolving digital landscape, technology is transforming every industry, including the automotive sector. The days of physically visiting multiple dealerships or relying on outdated classified ads to buy or sell vehicles are a thing of the past. Platforms like NettyAuto.net are at the forefront of this transformation, offering a streamlined and efficient way to connect buyers and sellers in a tech-savvy world. This article will provide an in-depth analysis of how NettyAuto.net is reshaping the automotive industry, providing an unparalleled experience for users and making vehicle transactions smoother than ever before.

What is NettyAuto.net?

NettyAuto.net is an innovative online platform that serves as a marketplace for automobile transactions. It connects buyers and sellers through a user-friendly, digital interface that is designed to make the process of buying and selling cars as seamless as possible. Whether you’re looking for a brand-new car or a used vehicle, NettyAuto.net provides access to an extensive inventory of listings from both individual sellers and dealerships, making it a one-stop shop for all automotive needs.

Key Features of NettyAuto.net

- Vast Inventory of Cars

From luxury sedans to family SUVs, NettyAuto.net offers an extensive range of vehicles. Users can browse thousands of listings, compare prices, and explore vehicles of different makes and models, all from the comfort of their homes. - Advanced Search Functionality

NettyAuto.net features a sophisticated search engine with customizable filters, allowing users to narrow down their vehicle search based on parameters like price range, mileage, brand, model, year, and even specific features such as fuel type or transmission. - Comprehensive Vehicle Reports

Buyers can make informed decisions by accessing detailed vehicle history reports. This includes crucial information such as accident history, previous ownership, and maintenance records, giving buyers confidence in their purchases. - Real-Time Data and Analytics

One of the standout features of NettyAuto.net is its integration of real-time data and analytics. Users can view up-to-the-minute pricing trends, market insights, and availability, helping both buyers and sellers stay competitive in the dynamic automotive market. - Secure Transactions

The platform prioritizes security, offering secure payment gateways and protecting user data with advanced encryption technologies. This ensures that users can complete their transactions with peace of mind. - Mobile Compatibility

With mobile usage on the rise, NettyAuto.net offers a fully optimized mobile experience, allowing users to browse listings, contact sellers, and make transactions from their smartphones or tablets.

The Technological Edge of NettyAuto.net – How It’s Changing the Industry?

Technology plays a crucial role in how NettyAuto.net is revolutionizing the automotive marketplace. By incorporating cutting-edge digital tools, the platform is setting new standards for efficiency, convenience, and transparency in vehicle transactions.

Real-Time Data for Informed Decision-Making

Access to real-time data is one of the key benefits for users of NettyAuto.net. Buyers can view up-to-date listings, pricing changes, and market trends in real-time, enabling them to make well-informed decisions. Sellers, on the other hand, benefit from insights into current market demand, helping them price their vehicles competitively.

Enhanced User Experience with Intuitive Design

A major factor that sets NettyAuto.net apart from other automotive platforms is its user-friendly interface. The platform’s clean and intuitive design ensures that even individuals with limited technological experience can navigate the site with ease. The well-structured layout reduces clutter and provides a straightforward experience, enabling users to find the information they need without unnecessary distractions.

AI-Driven Search and Recommendations

NettyAuto.net leverages artificial intelligence (AI) to enhance the user experience. The AI-powered search engine not only helps users find vehicles that meet their exact specifications but also offers personalized recommendations based on user preferences and browsing behavior. This feature helps users discover vehicles that they may not have considered but are likely to meet their needs.

Virtual Showrooms and Digital Vehicle Walkthroughs

One of the standout features on NettyAuto.net is the ability to virtually tour vehicles through digital showrooms and 360-degree video walkthroughs. This immersive experience allows potential buyers to get a detailed look at the vehicles they are interested in without having to visit a dealership in person.

How NettyAuto.net Benefits Both Buyers and Sellers?

NettyAuto.net offers a unique set of advantages to both car buyers and sellers, making it an essential tool in the modern automotive market.

For Buyers: Convenience and Transparency

- Access to a Wide Range of Vehicles

Buyers have access to thousands of vehicles from different sellers, ranging from individual listings to professional dealerships. This variety ensures that there is something for everyone, whether they are looking for a budget-friendly used car or a brand-new luxury vehicle. - Streamlined Search and Comparison

The platform’s advanced filters allow buyers to narrow down their search quickly and efficiently. This helps them avoid sifting through irrelevant listings and focus on finding the perfect car for their needs. - Comprehensive Information at Their Fingertips

Buyers can access detailed vehicle reports, including information about the car’s history, previous owners, accident records, and more. This level of transparency builds trust and helps buyers make informed decisions. - Virtual Tours and Easy Communication

Virtual tours make it easy for buyers to assess a car’s condition without physically visiting the dealership. The platform also allows for direct communication with sellers, facilitating faster negotiations and transactions.

For Sellers: Increased Visibility and Easier Transactions

- Exposure to a Large Audience

Sellers benefit from NettyAuto.net’s wide reach, which connects them with thousands of potential buyers. Whether an individual is trying to sell a personal vehicle or a dealership is looking to move inventory, the platform provides an effective way to reach a broader audience. - Data-Driven Insights

Sellers can leverage real-time market data to price their vehicles competitively. This ensures that they are aligning their pricing strategy with current market conditions, leading to quicker sales. - Ease of Use

Listing a car on NettyAuto.net is simple, and sellers can manage their listings with ease. The platform allows for the upload of high-quality images and videos, helping sellers showcase their vehicles in the best light.

Why NettyAuto.net Stands Out in a Competitive Market?

While there are many online automotive marketplaces, NettyAuto.net distinguishes itself through its focus on user experience, transparency, and technology-driven solutions. Its commitment to providing users with the latest tools and insights sets it apart from competitors, ensuring that users have a superior experience whether they are buying or selling a vehicle.

Comprehensive Support System

In addition to its innovative features, NettyAuto.net offers a robust customer support system. Users can access FAQs, chat with representatives, or consult detailed guides on how to make the most of the platform, further enhancing their experience.

Competitive Edge in SEO and Marketing

NettyAuto.net also stands out by utilizing SEO-friendly practices that drive organic traffic to the site. This benefits sellers by increasing visibility for their listings and helps buyers by delivering more relevant search results based on the latest algorithms.

Conclusion: The Future of Automotive Transactions with NettyAuto.net

As technology continues to evolve, platforms like NettyAuto.net are leading the way in transforming the automotive industry. By offering a seamless, user-friendly, and technologically advanced marketplace, the platform provides a unique solution for both buyers and sellers. Whether you’re looking to purchase your next car or sell your current vehicle, NettyAuto.net is the go-to resource for efficient, transparent, and secure transactions.

Also Read: pedrovazpaulo business consultant

FAQs About NettyAuto.net

- What is NettyAuto.net?

NettyAuto.net is an online automotive marketplace that connects buyers and sellers, offering a wide range of vehicles and tools to streamline the buying and selling process. - How does NettyAuto.net benefit buyers?

Buyers can access a vast inventory, utilize advanced search filters, view vehicle history reports, and even take virtual tours of cars, making it easier to find the right vehicle. - Is NettyAuto.net secure for transactions?

Yes, the platform uses advanced encryption and secure payment gateways to ensure that all transactions are safe and protected. - What types of vehicles are available on NettyAuto.net?

The platform offers a variety of vehicles, from sedans and SUVs to trucks and luxury cars, catering to different preferences and budgets. - Can I list my car on NettyAuto.net?

Yes, both individual sellers and dealerships can list vehicles for sale on the platform. The process is simple, and sellers can manage their listings with ease. - Does NettyAuto.net provide vehicle history reports?

Yes, buyers can access detailed vehicle history reports, which include information on prior ownership, accidents, and maintenance. - Is there a mobile version of NettyAuto.net?

Yes, NettyAuto.net is fully optimized for mobile use, allowing users to browse and manage transactions on their smartphones or tablets. - How does NettyAuto.net use real-time data?

The platform offers real-time data on market trends, pricing fluctuations, and vehicle availability, helping both buyers and sellers stay competitive. - Can I negotiate prices on NettyAuto.net?

Yes, buyers can communicate directly with sellers through the platform to negotiate prices and discuss details. - Does NettyAuto.net charge for listings?

NettyAuto.net offers various listing options, including free and premium services, depending on the seller’s needs.

Blog

Baby:57cot6bg0lw= Shrek – A Fresh Chapter in the Beloved Shrek Universe

Baby:57cot6bg0lw= Shrek – A Fresh Chapter in the Beloved Shrek Universe

The Shrek franchise has stood the test of time, captivating audiences with its unique blend of humor, heart, and enchanting storytelling.

Now, Baby:57cot6bg0lw= Shrek breathes new life into this animated universe, offering an exciting perspective on Shrek and Fiona’s legacy through the eyes of their curious and mischievous son.

This fresh spin-off adds depth to the Shrek series while resonating with younger audiences and long-time fans alike.

In this comprehensive article, we’ll dive into the origins of Baby:57cot6bg0lw= Shrek, its key themes, character development, production insights, cultural impact, and much more. Let’s explore how this spin-off enriches the magical world of Shrek.

The Shrek Legacy: Setting the Stage for Baby:57cot6bg0lw= Shrek

When Shrek premiered in 2001, it broke new ground in animation, earning acclaim for its innovative storytelling, lovable characters, and timeless humor.

Over the years, the franchise expanded with sequels, spin-offs, and a treasure trove of merchandise, cementing its place in pop culture.

Baby:57cot6bg0lw= Shrek builds on this rich legacy, capturing the essence of the original films while tailoring its narrative for a new generation.

This charming spin-off shifts the focus to Shrek and Fiona’s youngest child, offering fans a delightful glimpse into the early years of their magical family.

What is Baby:57cot6bg0lw= Shrek?

Baby:57cot6bg0lw= Shrek is an animated series that centers on the adventures of Shrek and Fiona’s youngest son. With its lighthearted humor, imaginative world-building, and meaningful life lessons, the series appeals to children aged 3 to 8, as well as their parents.

The show introduces Baby Shrek as a curious and endearing character navigating life’s challenges with his signature blend of innocence and mischief. Alongside familiar faces like Donkey and Puss in Boots, Baby Shrek embarks on whimsical adventures that entertain and teach valuable lessons about family, friendship, and self-discovery.

Origins and Development of Baby:57cot6bg0lw= Shrek

The idea for Baby:57cot6bg0lw= Shrek emerged from a desire to create content that would engage younger audiences while preserving the humor and heart of the original films. The development team, consisting of experienced animators and writers, worked meticulously to ensure the show stayed true to the Shrek legacy.

The narrative explores the formative years of Baby Shrek, allowing viewers to witness his growth, challenges, and adventures in the magical kingdom of Far Far Away. Each episode introduces new characters, lessons, and lighthearted moments that keep audiences hooked.

Key Characters in Baby:57cot6bg0lw= Shrek

1. Baby Shrek

The heart of the series, Baby Shrek is a curious and mischievous character whose innocence and humor drive the storyline. Through his adventures, he learns important lessons about courage, kindness, and self-acceptance.

2. Fiona (Young Mother)

Fiona plays a central role as Baby Shrek’s guiding force. Her strength, wisdom, and warmth provide a steadying presence in Baby Shrek’s life.

3. Donkey and Puss in Boots

Beloved characters Donkey and Puss in Boots return as Baby Shrek’s playful companions. Their comedic antics add levity to the series while helping Baby Shrek navigate his world.

4. New Characters

The series introduces an array of new characters that enrich the narrative. From Baby Shrek’s quirky friends to whimsical creatures in Far Far Away, these additions keep the show fresh and engaging.

Themes Explored in Baby:57cot6bg0lw= Shrek

1. Family and Friendship

At its core, Baby:57cot6bg0lw= Shrek emphasizes the importance of family and friendships. Each episode weaves heartwarming narratives that teach young viewers about empathy, cooperation, and the strength of relationships.

2. Learning Through Adventures

The series is a treasure trove of life lessons, blending entertaining adventures with educational themes. From solving problems to understanding different perspectives, Baby Shrek’s journey encourages children to embrace curiosity and resilience.

3. Humor and Heart

In true Shrek fashion, the spin-off balances humor with emotional depth. Baby Shrek’s escapades are filled with laughter, while tender moments add a layer of relatability that resonates with both children and parents.

Discover the Magic Behind the Production Insights and Animation Quality of Baby:57cot6bg0lw= Shrek

The magic of Baby:57cot6bg0lw= Shrek lies not only in its storytelling but also in its remarkable production quality. The series showcases stunning animation that aligns seamlessly with the vibrant and whimsical aesthetic of the original Shrek films.

Every detail, from the lush landscapes of Far Far Away to the expressive character designs, demonstrates the production team’s commitment to excellence. This attention to detail enriches the narrative, drawing viewers into a visually captivating experience.

Behind the scenes, the creators used cutting-edge animation techniques to breathe life into Baby Shrek’s adventures. Advanced rendering technologies enhance the textures and colors, ensuring each frame radiates warmth and magic. Beyond the visuals, heartfelt voice acting adds depth and personality to every character, making their emotions and interactions feel authentic and relatable.

The production team worked tirelessly to ensure Baby:57cot6bg0lw= Shrek resonates with both nostalgic longtime fans and younger audiences experiencing the Shrek universe for the first time. Their creative synergy produced a series that feels both fresh and familiar, appealing to viewers of all ages.

If you’ve yet to explore this delightful series, now is the time to dive in and witness the extraordinary craftsmanship that brings Baby Shrek’s world to life. Join the adventure and see why Baby:57cot6bg0lw= Shrek is a must-watch!

Cultural Impact of Baby:57cot6bg0lw= Shrek

Revitalizing the Franchise

Baby:57cot6bg0lw= Shrek revitalizes the Shrek franchise by introducing a fresh perspective. By focusing on Baby Shrek’s adventures, the series ensures that the Shrek legacy remains relevant for a new generation of viewers.

Inspiring Merchandise

The spin-off has sparked a wave of merchandise, from plush toys to clothing and school supplies. Baby Shrek’s popularity has made him a favorite among children, solidifying his place as a cultural icon.

Comparisons with Other Animated Spin-Offs: What Makes Baby:57cot6bg0lw= Shrek Stand Out?

While many animated spin-offs aim to capture audience nostalgia, Baby:57cot6bg0lw= Shrek takes a refreshing approach by delivering original narratives crafted specifically for younger viewers.

Unlike its predecessors or contemporaries, the series doesn’t solely rely on the legacy of its source material. Instead, it carves out its own identity by presenting engaging stories that resonate with children while retaining the charm of the Shrek universe.

Popular spin-offs like Puss in Boots or The Penguins of Madagascar are celebrated for their action-packed sequences and quick-witted humor.

However, Baby:57cot6bg0lw= Shrek strikes a distinct balance, seamlessly blending heartwarming moments, laugh-out-loud humor, and valuable life lessons. This blend ensures the series appeals to children while still capturing the interest of parents and older fans.

By offering more than just entertainment, Baby:57cot6bg0lw= Shrek emerges as a thoughtful, meaningful addition to the world of animated spin-offs, making it a standout choice for family viewing.

Also Read: tex9.net

Why Parents Love Baby:57cot6bg0lw= Shrek: A Perfect Family Choice!

Parents adore Baby:57cot6bg0lw= Shrek for its wholesome, family-friendly content and the meaningful messages it conveys. The series provides an entertaining yet educational viewing experience, making it a valuable addition to family time.

Through engaging stories and endearing characters, the show introduces young audiences to important themes such as kindness, perseverance, and self-discovery.

Parents also appreciate the show’s balance of humor and heart, which ensures it remains enjoyable for adults as well. Its ability to spark conversations about life lessons and moral values further enhances its appeal, cementing its place as a go-to choice for shared family moments.

Future Prospects for Baby:57cot6bg0lw= Shrek: Expanding the Shrek Universe

With its growing popularity, Baby:57cot6bg0lw= Shrek has significant potential for an exciting future. Its success paves the way for additional seasons, creative spin-offs, or even a leap into feature films.

The show’s unique charm and ability to resonate with audiences of all ages suggest it could become a lasting pillar within the Shrek franchise.

Expanding Baby Shrek’s adventures could explore deeper storylines, introduce new characters, and delve into unexplored corners of the Shrek universe.

With dedicated fans eager for more content, the series holds the promise of evolving into a cultural phenomenon, ensuring its legacy for years to come.

Conclusion

Baby:57cot6bg0lw= Shrek is a delightful addition to the Shrek franchise, blending humor, heart, and life lessons in a way that captivates audiences of all ages. Its imaginative storytelling, engaging characters, and cultural impact ensure that the Shrek legacy continues to thrive.

Whether you’re a long-time fan or discovering Shrek’s world for the first time, Baby:57cot6bg0lw= Shrek offers a magical journey filled with adventure and warmth.

FAQs

- What is Baby:57cot6bg0lw= Shrek?

Baby:57cot6bg0lw= Shrek is a spin-off series focusing on the adventures of Shrek and Fiona’s youngest son. - Is Baby:57cot6bg0lw= Shrek suitable for children?

Yes, the series is designed for children aged 3 to 8 and features family-friendly content. - What themes does Baby:57cot6bg0lw= Shrek explore?

The series explores themes like family, friendship, self-discovery, and learning through adventures. - Are original Shrek characters part of the spin-off?

Yes, characters like Donkey, Puss in Boots, and Fiona make appearances alongside new additions. - How does Baby:57cot6bg0lw= Shrek compare to other spin-offs?

It stands out by blending humor, heart, and educational value, making it unique among animated spin-offs. - Will there be more seasons of Baby:57cot6bg0lw= Shrek?

Given its popularity, there’s strong potential for additional seasons or even feature-length films. - Who is the target audience for Baby:57cot6bg0lw= Shrek?

The primary audience is young children, but the series also appeals to parents and long-time Shrek fans. - What kind of merchandise is available for Baby:57cot6bg0lw= Shrek?

Merchandise includes toys, clothing, and school supplies featuring Baby Shrek and his adventures. - Who produced Baby:57cot6bg0lw= Shrek?

The series was created by a talented team of animators and writers who worked on the original Shrek films. - Where can I watch Baby:57cot6bg0lw= Shrek?

The series is available on major streaming platforms and select television networks.

Blog

FAQ About Dental Implants

While bridges and dentures rest on gums, dental implants fuse to the jawbone, mimicking natural teeth. Titanium posts anchor crowns or dentures securely to help improve a patient’s ability to eat and speak. Implants may help prevent bone loss in the jaw caused by missing tooth roots. Here are some FAQs about implants:

What Is the Implant Procedure Like?

An implant’s titanium post is surgically inserted into your jaw to mimic a natural tooth root. Once the titanium post infuses with your bone, dentists can attach custom-made crowns, bridges, or dentures. Recovery times vary from patient to patient. Follow-up visits allow your doctor to monitor post-placement bone fusion and gum healing.

What Are the Types of Implants?

Types of dental implants include:

- Single-tooth implant: replaces a single missing tooth

- Multiple-tooth implant: replaces a few consecutive teeth

- Full-mouth implant: replaces teeth in the upper or lower jaw or both

Your dentist will help you select the right implant type based on your needs.

Who Is Eligible for Implants?

Jawbone density and oral health may impact dental implant candidacy. A strong jawbone helps anchor titanium posts in implants. Prior bone grafts could elevate implant success chances by increasing bone volume. Dentists also evaluate gum condition and tooth decay before recommending implants. For patients with certain medical conditions, such as diabetes, autoimmune disorders, or osteoporosis, pre-treatment consultations with specialists help determine implant candidacy.

What Is the Post-Surgery Healing Process?

Dental implant recovery usually occurs in stages. The jawbone fuses around the titanium post during the first few months. When placement is complete, your gums heal over the post. Dentists install temporary crowns to protect implants until durable permanent crowns adhere. Complete fusion of the jaw and implant marks the procedure’s end. This process may take several months.

As the surgery site heals, dentists usually recommend eating soft foods like smoothies and soups to avoid irritation. As your tolerance increases, re-incorporate harder foods into your diet. To reduce pain, take ibuprofen or a prescribed painkiller as directed.

How Do I Care for and Maintain Implants?

Oral hygiene helps maintain dental implant functionality. Dentists often recommend brushing twice daily with a soft-bristled brush to keep crowns free of plaque buildup. Flossing helps dislodge trapped food particles or bacteria. Use an antibacterial mouth rinse as directed to cleanse hard-to-reach areas.

Are Implants Painful?

Trained dental surgeons use local anesthesia to maximize patient comfort during minimally invasive procedures. The implant process requires surgery, but most patients experience only mild postoperative discomfort. Most dentists offer guidelines to mitigate swelling and soreness that may develop afterward.

Can I Get Multiple Implants at Once?

Dentists routinely place multiple implants during the same procedure. Placing neighboring posts in one session can consolidate recovery time. Strategically staged implant placement may suit total teeth replacement needs. Preparing for the possibility of additional implants may optimize outcomes.

Ask Your Dentist About Dental Implants Today

Crowns, dentures, and bridgework are common tooth-replacement options, but many prefer implants for their natural appearance and durability. Properly placed implants do not move, shift, or slip, making restoring your natural bite, speech, and smile easy. Contact a dentist today to ask if implants are right for you.

-

HEALTH12 months ago

HEALTH12 months agoHealthSciencesForum.com

-

Tech1 year ago

Tech1 year agoRTG Sportsbook: A Comprehensive Guide to a Superior Betting Experience

-

Blog1 year ago

Blog1 year agoExploring Kazwire: Your Gateway to Unblocked Gaming and Web Browsing

-

Blog2 years ago

Blog2 years agoViolet Myers Passed Away: A Comprehensive Exploration

-

Blog1 year ago

Blog1 year agoWhat To Look for When Buying THCa Flower Online

-

Blog2 years ago

Blog2 years agoIs haband going out of business? Separating Rumor from Reality

-

Tech1 year ago

Tech1 year agoUnlocking the Secrets of ahr0chm6ly9wcm9ka2v5cy5uzxqvexv6ds1wcm9klwtlexmv – A Comprehensive Guide

-

Blog2 years ago

manhwa18cc